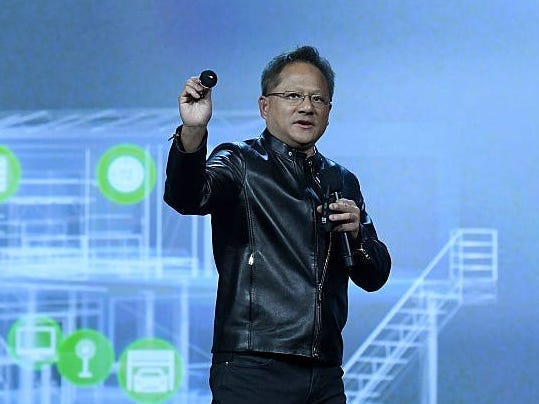

Nvidia Shares Rise as CEO Huang Reports Surging Demand for Blackwell AI Superchip

Nvidia’s CEO Jensen Huang reported that demand for the company’s new Blackwell “Superchip” is “insane,” leading to a more than 3% increase in Nvidia’s stock on Thursday.

Key Details

On Thursday, Nvidia’s shares peaked at $124.26 before settling at $122.80, marking a 3.3% rise. Huang highlighted the overwhelming interest in the Blackwell chip during a CNBC interview, noting that major tech firms like Microsoft, OpenAI, and Meta are eager to adopt the new technology. He stated, “Everybody wants to have the most, and everybody wants to be first.”

This surge in stock follows a series of gains for Nvidia, particularly after a drop in early September when shares fell to $102.83 despite reporting record revenue.

Upcoming Launch

Nvidia plans to deliver Blackwell-based products to cloud services operated by Oracle, Amazon, Microsoft, and Google by late this year. The Blackwell chip is designed to train AI models quickly while maintaining low energy consumption, with each unit expected to cost between $30,000 and $40,000.

Stock Market Context

While Nvidia shares rose, the overall market faced challenges. The S&P 500 declined, and the tech-heavy Nasdaq fell by 0.17%. Huang’s net worth increased by $3 billion, now estimated at $107 billion, making him the twelfth-richest person in the world.

Conclusion

Nvidia’s Blackwell chip is poised to reinforce the company’s leadership in the AI sector. The firm continues to supply critical technology to industry giants like Microsoft, Meta, Alphabet, and Amazon, which collectively contribute significantly to its revenue. Despite recent fluctuations, Nvidia’s stock has surged over 147% since the beginning of the year, when shares were priced at $48.17. The company’s datacenter division, which includes AI products, reported $26.3 billion in revenue during the last quarter, a remarkable 154% increase year-over-year.